YG expectations are high... SM concerns for momentum and earnings

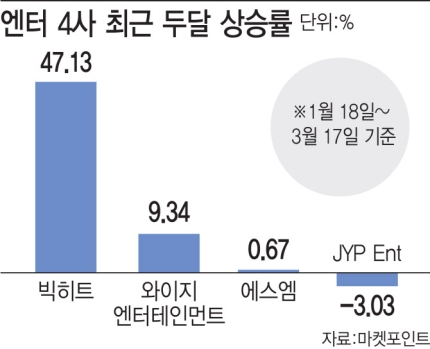

...(January 18-March 19). During the same period, YG Entertainment recorded a profit of 5.96%, JYP Ent. -1.53% and SM -2.19%.

Metaverse is a combination of meta, which means virtual and transcendence, and universe, which means world and space. It is a broad concept that refers to a virtual world in which reality and unreality coexist.

Entertainment contents in the metaverse are inevitably developed, and as the non-face-to-face service is activated due to Corona 19, it is developing as a window of communication centered on Generation Z.

Expectations for YG Entertainment's growth potential are also high in the market. Black Pink, a girl group under YG Entertainment, also held a fan signing event last year through Naver's representative metaverse platform'Zeppetto'. At that time, 50 million fans flocked to ZEPETO, and they communicated with Black Pink through avatars.

YG, led by Black Pink, recorded an operating profit of 10.7 billion won, an increase of 1094.22% compared to the previous year, with IPs such as albums, music sources, and celebrity-related goods (MD), despite the full cancellation of offline performances due to Corona 19. The operating profit was 16.70% higher than the consensus.

YG's recent fair value consensus was 62,275 won, up 6.25% from two months ago. In addition, a number of securities firms recently raised YG's 1Q earnings forecasts. The 1Q operating profit consensus jumped to 6 billion won.

"YG has an artist and IP optimized for metaverse," said Lee Sun-hwa, a researcher at KB Securities. "YG is diversifying their profit model by operating a virtual exhibition hall (virtual reality map)."

JYP Entertainment, which has been showing steady results, has seen little change in its fair value consensus over the past three months.

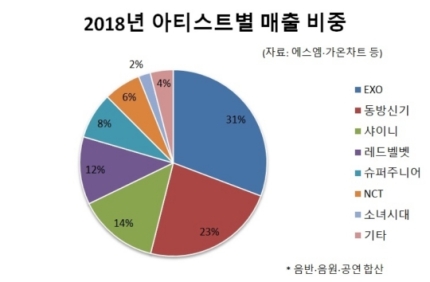

The most worrying stock in the market is SM. SM recorded an operating profit of 6.5 billion won last year, a decrease of 83.92% from the previous year and a net loss for the second year in a row. In particular, in the fourth quarter of last year, operating profit was only 1.3 billion won, falling 77.47% below the consensus.

Intangible assets impairment losses and losses from associates and investments recorded a net loss of KRW 66.2 billion. As 38 affiliates are taking turns creating unexpected bad news, the possibility of predicting earnings is very low. As more brokerage firms lower their target price, the recent fair value consensus fell 5.85% from two months ago.

In-Hae Ji, a researcher at Hanwha Investment & Securities, analyzed that improvement is urgent, considering that "SM is not big among both the artist momentum and performance leading entertainment stocks." He added, “In order to recover share price momentum, we will need to present a high-margin model in terms of digital business.”

It's all metaverse beneficiaries... Enter 4 companies with mixed views

Input 2021.03.18. 1:41 am

... Fair value rising, YG expectations

ahead of Black Pink ↑… 1Q11 outlook hosiljeok multi 'earnings shock "SM bigger concern ... “The situation where improvement is urgent”

[E-Daily Reporter Yong-Seok Cho] Amidst growing expectations for entertainment items, which are considered to be the key beneficiaries of the'Metaverse ' era, joys are striking among them. The market's expectations for the Big Hit ( 352820 ), which were controversial at the time of the public offering, are rising, while SM ( 041510 ) continues to be disappointed by the continuous earnings shock.

|

Expectations are also high for YG

Entertainment ( YG ). YG, with Black Pink in the lead , compared to last year with IPs such as albums, music sources, and celebrity-related goods ( MD ) despite the total cancellation of offline performances due to Corona 19It recorded an operating profit of 10.7 billion won, an increase of 1094.22 % . The operating profit is 16.70 % higher than the consensus .

Lee Seon-hwa KB Securities researcher " YG is optimized for the metaverse artists and IP holds" and "already black pink IP and the public to hold and music videos for the fan meet in virtual worlds based on the virtual exhibition (virtual reality We are diversifying our profit model, such as operating a map).”

YG 's recent fair value increased by 6.25 % compared to two months ago to a consensus of 62,275 won . More recently a number of brokerage YG and up to one quarter of the projections, for the past one quarter youngeopik consensus 60 eokwon month (as 27 compared million) 124.8 The upstream% or adjustment. JYP Entertainment, which has been showing steady earnings, has seen little change in its fair value consensus for the past three months.

The stock market is most concerned about is SM. SM recorded an operating profit of 6.5 billion won last year , a decrease of 83.92 % from the previous year , and net loss for the second year in a row. In particular, the consensus was 77.47 in the fourth quarter of last year.Operating profit ( 1.3 billion won) was only below % , and net loss of 66.2 billion won was recorded due to impairment loss on intangible assets and losses on associates and investments . As more brokerage firms lower their target price, the recent fair value consensus fell 5.85 % compared to two months ago .

In-Hae Ji, a researcher at Hanwha Investment & Securities, said, “The factors that lead entertainment stocks are either high artist momentum or good performance (valuation). Park Seong-ho, a researcher at Yuanta Securities, said, “As of the third quarter of last year, 38 affiliates alternately creating unexpected bad news, so the predictability of SM’s earnings is very poor.” I will do it.”