Reinforcements Finally Arriving

YG Entertainment: Concerns to Be Resolved

The author is an analyst of NH Investment & Securities. She can be reached at hzl.lee@nhqv.com. -- Ed.

In early January, YG Ent released both a teaser for the launch of a new girl group and plans for G-Dragon’s solo activities. We anticipate that the firm’s biggest weakness (ie, excessive dependence on Blackpink) will soon be resolved. In addition, Blackpink’s contract renewal should go smoothly. We adhere to a Buy rating and TP of W77,000.

Reinforcements finally arriving

We maintain a Buy rating and TP of W77,000 on YG Entertainment (YG Ent).

Since the resolution of an issue related to general manager Hyunsuk Yang at end-December, YG Ent has been strengthening its business overall. Regarding the decision not to renew contracts with some artists, it is believed that the firm is choosing to concentrate its efforts on a core group of main artists. In early January, the company released a teaser for the launch of a new girl group (Baby Monster), alongside the announcement by G-Dragon himself that he will resume solo activities this year. In the case of Baby Monster, members’ performance teaser videos are being released every week to a favorable public response. Concerns over excessive reliance on a single artist (Blackpink) are to be resolved through the addition of a promising new group and G-Dragon.

Blackpink contract renewal only a matter of time

Despite a variety of momentum sources, YG Ent shares remain undervalued to those of peers (HYBE, JYP Ent, SM Ent). As Blackpink’s August contract expiration approaches, related concerns are being reflected. However, we see little need for a negative reaction to this upcoming event, as considering the practical benefits to both the artists and the firm, contract renewal will likely go smoothly. Now is the time to let go of excessive concerns.

4Q22 preview: Beginning of Blackpink world tour effects

We forecast consolidated 4Q22 sales of W145.5bn (+64% y-y) and OP of W23bn (+74% y-y), with both figures to meet consensus.

Ticket and MD revenue related to Blackpink’s world tour (24 shows in the West and 2 shows in Korea) should prove sound. In addition, revenue is to be reflected in relation to Treasure’s Japan tour. In 4Q22, while the only new album release was from Treasure (570,000 copies), deferred sales related to Blackpink’s September album launch were likely recorded. Digital track revenue should also come in sound, as Blackpink’s new album continues to be a hit, and 2H22 revenue for China should be recognized in 4Q22.

Korea Economy

YG Entertainment bullish on stock market observations of "Blackpink's contract renewal"

Input 2023.01.19. 9:45 a.m.

view original

view original

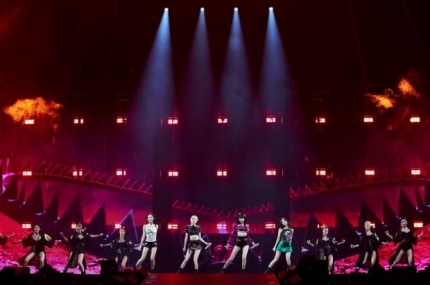

Black Pink. Photo = YG Entertainment

YG Entertainment's stock price is showing a strong performance in the early hours of the market on the 19th, thanks to a brokerage report predicting a high possibility of renewing Blackpink's contract.

As of 9:34 am on the same day, YG Entertainment is trading at 51,300 won, up 1,650 won (3.32%) from the previous day.

Previously, on the same day, NH Investment & Securities issued a YG Entertainment stock analysis report and observed that there was a high possibility of renewing the contract with Blackpink. Lee Hwa-jeong, a researcher at NH Investment & Securities, said,“The fact that the stock price is still undervalued compared to competitors even though there are several momentums is a reflection of concerns as Blackpink’s contract expiration date approaches, which is until August this year.”

There is no need to guess and react. Blackpink's contract renewal is expected to proceed smoothly, so it is time to put down excessive concerns."

In addition, with the new girl group 'Baby Monster' and G Dragon's activity plans being recently revealed, Lee also diagnosed that the company's problem of 'excessive dependence on a single artist', which had been pointed out so far, has been resolved.

Meanwhile, on the same day, YG Entertainment first released the dance performance video of 'Baby Monster' on its official blog. The video contains scenes of five members Luca, Haram, Asa, Laura, and Ahyeon practicing their dance.

Market and Money Characteristics

YG Entertainment's share price bullish during the intraday, expectations for a new girl group and GD's solo are positive

Reporter Lee Han-jae piekielny@businesspost.co.kr 2023-01-19 11:41:00

[Business Post] YG Entertainment's stock price is showing a bullish intraday. Investor sentiment seems to have improved due to expectations for a new girl group and GD (G-Dragon) solo activities.

▲ On the 19th, YG Entertainment's stock price is showing a bullish trend. The photo is a teaser video of YG Entertainment's new girl group 'Baby Monster'.

At 11:30 am on the 19th, YG Entertainment's stock price is trading at 51,800 won on the KOSDAQ market, up 4.33% (2,150 won) from the previous day. YG Entertainment's stock price rose 0.50% (250 won) to 49,900 won, and increased the rate of increase. At the same time, the KOSDAQ index fell 0.21% (1.49 points) to 710.26.

The prospect of the securities industry that the dependence on Blackpink may decrease seems to stimulate buying sentiment. Lee Hwa-jeong, a researcher at NH Investment & Securities, said in the report, "In early January, a teaser for the launch of the new girl group 'Baby Monster' and plans for GD (G-Dragon)'s solo activities were released." It will,” he predicted.

Researcher Lee said, "YG Entertainment has been accelerating its overall business since issues related to general manager Yang Hyun-suk were resolved at the end of December." It’s time to see.” Researcher Lee maintains YG Entertainment's investment rating of 'BUY' and target price of 77,000 won. Reporter Lee Han-jae

NHK "YG, possibility of renewing BLACKPINK's contract increases... Concerns overblown"

- Reporter's nameCorrespondent Yuhansae

Black Pink. (Photo courtesy of YG Entertainment)

Black Pink. (Photo courtesy of YG Entertainment)

[Newsworks = Reporter Yoo Han-sae] As YG Entertainment's Blackpink contract expired, the share price was undervalued compared to its competitors, but this was due to excessive concerns, and the stock market predicted that the contract renewal was highly likely.

On the 19th, NH Investment & Securities said that the excessive dependence on a single artist from YG Entertainment would be resolved, and that Blackpink's contract renewal would go smoothly. We maintain our Buy rating and target price of KRW 77,000. The closing price of YG Entertainment on the previous trading day is 49,650 won.

After the issue related to Yang Hyun-suk was resolved at the end of last December, YG Entertainment's business as a whole accelerated. They are showing a desire to organize some artist lineups and accelerate business progress centered on key artists.

At the beginning of this month, a teaser for the launch of the new girl group 'Baby Monster' was released, and in the case of GD, he himself announced that he would resume his solo activities within the year. In the case of Baby Monster, the public's reaction is generally favorable in a situation where the members' performance teaser videos are released every week.

Lee Hwa-jeong, a researcher at NH Investment & Securities, said, "This is a period where the excessive dependence on a single artist is resolved as new artists are added to support GD."

He said, "Despite the existence of various momentum, YG Entertainment's stock price is still undervalued compared to competitors," he said. "As Blackpink's contract expiration (August 2023) approaches, related concerns are reflected."

Researcher Lee drew the line that there would be no need to anticipate and react negatively in relation to BLACKPINK's contract renewal. He explained, "Considering the practical benefits of both the artist and the company, the renewal of the contract will go smoothly," adding, "It is time to put down excessive concerns."

Researcher Lee predicted that YG Entertainment's consolidated sales in the fourth quarter of last year would increase by 64% year-on-year to KRW 145.5 billion, and operating profit would increase by 74% year-on-year to KRW 2.3 billion.

He said, "We expect good results by reflecting the ticket and MD revenue related to the Blackpink world tour," and "Treasure's Japanese tour-related revenue will also be recognized."

"In the case of new releases, there was only Treasure (570,000 copies), but it is understood that deferred volume related to Blackpink's album released in September will be reflected." As this is the quarter in which this is recognized, good music results will continue."